偶一直在想到底要做什麼股才好, 網上看到這個網站還很方便:

http://www.2xetfs.com/

一看 QLD/QID 成交量比 TQQQ/SQQQ 大許多 並且歷史資料也長許多 ... 偶就先暫時看它們好了 ...

SSO/SDS 成交量比 SPXL/SPXS 或 UPRO/SPXU 大許多 並且歷史資料也長許多 ... 偶也就先暫時看它們好了 ... 雖然只是 2X 的 ... 偶先做做看 ... 看看倍數會不會太低或是剛好 ...

TBT 成交量滿大的 ... 可是為什麼 UBT 成交量這麼小? 不管了 ... 反正偶只做成交量大的!

本來想將所有要看得ETFs分成正反指兩個表列 ... 現在想想 ... 偶跟本就是庸人自擾!

就這樣了 - 偶把所有的全放在一個 list 中 ... 管它是ABC還是XYZ ... 反正就從這 list 挑股票出 來買就是了!

同學記不記得上次偶們有做過討論是要用哪些 underlying 的股票來發出進出場的信號?

偶現在想想 ... 這也是偶庸人自擾! 因為如果以長線眼光來看 短線所發出的分歧信號 在長線的環境之下變得不是這麼的明顯了! 所以偶還是輕鬆點! 做什麼股就看什麼圖! 不要把自己搞得太累!

OK. There are 17 ETFs in our final list:

EDC, EDZ, ERX, ERY, FAS, FAZ, NUGT, QID, QLD, SCO, SDS, SSO, TBT, TNA, TZA, UCO, XME

(Updated on 08/11/2012)

I found this website from the Web:

http://finance.yahoo.com/news/etf-tax-tutorial-complete-list-130037114.html

It lists all ETFs that Issue a K-1, which I will avoid. Therefore, I need to remove SCO and UCO from our stock list.

Now our final list becomes shorter (15 ETFs), and it makes my life easier to monitor:

EDC, EDZ, ERX, ERY, FAS, FAZ, NUGT, QID, QLD, SDS, SSO, TBT, TNA, TZA, XME

(Updated on 08/12/2012)

According to this article:

http://etfdailynews.com/2010/12/06/understanding-how-etfs-and-etns-are-taxed-spy-uso-gld-slv/

"... Another form of commodity ETFs that are taxed at an unfriendly rate are grantor trusts which hold physical metals, like the SPDR Gold Shares (NYSE:GLD) and the iShares Silver Trust (NYSE:SLV). These funds are deemed as collectibles by the IRS and taxed at 28%. On the bright side, they do not generate realized capital gains or interest income. ..."

Therefore, please remember me to think again if I want to add GLD or SLV to any of my funds in the future. (Current I won't do that be cause I trade GC futures contract.)

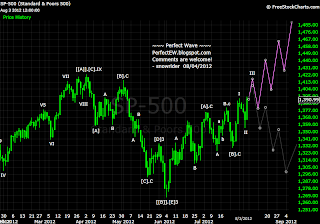

Perfect EW (Perfect Elliott Wave): The new intepretation on the classical Ralph N. Elliott's The Wave Principle without some other famous modern version's erroneous wave counting and labeling problems. PLEASE JOIN AS A FOLLOWER, FOR I AM GOING TO CLOSE THE DOOR AND CONVERT THIS TO A PRIVATE CLUB VERY SOON. THANKS!

2012-08-10

2012-08-09

How to Avoid a Big Gap Down? (Part-II)

Part-I: http://perfectew.blogspot.com/2012/07/how-to-avoid-big-gap-down.html

I am going to have a revision on my stock watch list. Why? My current 1X ETFs are:

1. Some of them way too sluggish (e.g., XLU, VNQ)

2. Some of them very similar (e.g., QQQ vs. XLK)

I want something with good liquidity and also good volatility (but not too volatile). In order to avoid a big gap down, the trading timeframe will be in long term instead of short term.

I am suffering from being wandering around to find what stocks to trade. I never had this kind of problem on futures/FX trading. I should (must) narrow down the stock watch list! I got to do that ASAP!

I'll trade only one or two strongest 3X ETFs (which are diversified already) instead of holding many ETFs. In order to avoid the Wash Sale problem, we will need to have backup (replacement) stocks.

The following is my tentative watch list:

Bull: ERX, FAS, NUGT, SPXL, TBT, TNA, TQQQ, UCO, UPRO, XME

Bear: DUST, ERY, FAZ, SCO, SPXS, SPXU, SQQQ, TZA

--------------------------------

Note that this article has been updated on 08/10/2012. Please see The Final List for the latest watch list:

http://perfectew.blogspot.com/2012/08/the-final-list.html

I am going to have a revision on my stock watch list. Why? My current 1X ETFs are:

1. Some of them way too sluggish (e.g., XLU, VNQ)

2. Some of them very similar (e.g., QQQ vs. XLK)

I want something with good liquidity and also good volatility (but not too volatile). In order to avoid a big gap down, the trading timeframe will be in long term instead of short term.

I am suffering from being wandering around to find what stocks to trade. I never had this kind of problem on futures/FX trading. I should (must) narrow down the stock watch list! I got to do that ASAP!

I'll trade only one or two strongest 3X ETFs (which are diversified already) instead of holding many ETFs. In order to avoid the Wash Sale problem, we will need to have backup (replacement) stocks.

The following is my tentative watch list:

Bull: ERX, FAS, NUGT, SPXL, TBT, TNA, TQQQ, UCO, UPRO, XME

Bear: DUST, ERY, FAZ, SCO, SPXS, SPXU, SQQQ, TZA

--------------------------------

Note that this article has been updated on 08/10/2012. Please see The Final List for the latest watch list:

http://perfectew.blogspot.com/2012/08/the-final-list.html

Market Talk - EUR

From arthurwsp - Where would I be able to see your labelling of the "past" (meaning from 1996 to date) EUR/USD pair on a monthly and daily chart ?About my wave count of the long term view, I have posted a monthly chart the beginning of this thread, but it is not dated from 1996 that early. I don't have a wave count for that long term history. IMHO, it's more practical to view and trade with the view of near future.

From arthurwsp - EUR was given birth only in early 90's, and from MT4, I can see the chart from 1996, and that was why I was hoping you have some work done on the bigger picture. ... If we do not have a perspective, how would we be able to know whether we are trading a 5 waves (impulse) or a 3 waves (correction). I know that is an anticipation.Before EUR, it was DEM (Deutsche Mark), so we watch DEM's long term chart for the wave structure of EUR's pre-history wave. Yes, I agree with you that it will be easier to identify the wave if we know where we are. I have been trying to practice to identify a given wave factal to predict what next move could be. That becomes part of my daily life because I day-trade ES (SP futures index). In such a very micro timeframe of day trading, there is no easy way to really know where I am, except to identify the wave pattern in order to predict and trade.

From arthurwsp - I can see the difference between you and me now, but am surprised, because from your blog, you seemed to me to be a swing (long term) trader, but you day-trade ES.Actually, I day trade ES, swing trade ES if it goes bear market, swing trade EUR, JPR, gold, and long term trade stock. Currently, I guess that EUR is in wave-3._2. I guess that it will have a strong surge when it starts wave-3._3 this afternoon (New York time).

2012-08-08

2012-08-07

Count Grand Super Cycle Wave or Not?

A friend asked about if we want to analyze the wave count in grand super cycle degree. One thing that I would like to suggest is:

1. To trade the timeframe that we count the wave, and

2. To count the wave on the timeframe that we trade.

Why figuring out the wave count of a super high degree timeframe is not that important? If we think that it is important, do we also want to figure out the wave count of another higher degree timeframe (say from pre-history era)? Also, the key thing of trading with EW approach is to identify the structure of a given wave. How we can correctly identify a wave, and that is the key!

(Updated on 08/14/2012)

Trade Talk - Trade the Timeframe That We Count the Wave

1. To trade the timeframe that we count the wave, and

2. To count the wave on the timeframe that we trade.

Why figuring out the wave count of a super high degree timeframe is not that important? If we think that it is important, do we also want to figure out the wave count of another higher degree timeframe (say from pre-history era)? Also, the key thing of trading with EW approach is to identify the structure of a given wave. How we can correctly identify a wave, and that is the key!

(Updated on 08/14/2012)

Trade Talk - Trade the Timeframe That We Count the Wave

Why I Post EW Analysis

From stringfx - Hi Snowrider, I am a big fan of EW and your thread is an inspiration. I usually do my own analysis but i do not have anywhere to confirm my counts. I stumbled upon your thread and now i have somewhere to go for confirmation. Thank you. I do not trade stocks but your usd/jpy and eur/usd counts helps a lot. Is it possible for you to post gbp/usd as well? if it is possible and time permits you, i'd appreciate that a lot. Great thread !! Regardsstringfx - Thanks for your kind words! The way I see playing EW is like playing chess with the market. If we can get more people to watch the game, we get more ideas about what the market might be going to in its next move. There is no absolutely correct or wrong wave count because anything can happen. As long as we are prepared, we know how to respond to any market scenario. That's why I post my wave count every weekend and hope to get some commments from EW enthusiasts. About GBP, I used to trade those 4 major currencies (or 6 including CAD and AUD). Now I focus only on 2 currencies, so I do not follow Sterling. You are welcome to post your analysis here so that it can benefit everyone here, and also you would get feedback from people here.

2012-08-05

My Trade - 2012-08-W1

I am starting a new thread for the 1st week of August. All troops target on long term trading. All percentages are the dollar amount allocations of each troop. The following lists my positions as of last Friday:

Big Troop:

- TLT 35% (10%-04/10, 15%-05/01, 10%-07/27)

- SPY 45% (10%-07/05, 15%-07/06, 10%-07/11, 10%-07/24)

- Cash 20%

SAC Troop:

- EWS 15% (10%-07/30, 5%-07/31)

- XLF 22% (10%-07/30, 12%-07/31)

- QQQ 24% (24%-08/02)

- VNQ 25% (25%-08/02)

- Cash 14%

If you have any question about my trading (long term, short term, stock, or FX/Futures), please PM, and I'll be glad to help!

My Trade for last week:

http://perfectew.blogspot.com/2012/07/my-trade-2012-07-w5.html

PLEASE JOIN MY BLOG AS A FOLLOWER. I WILL PRIVATIZE THE BLOG ONCE WE REACH A SIZEABLE NUMBER OF AUDIENCE. THANKS!

Big Troop:

- TLT 35% (10%-04/10, 15%-05/01, 10%-07/27)

- SPY 45% (10%-07/05, 15%-07/06, 10%-07/11, 10%-07/24)

- Cash 20%

SAC Troop:

- EWS 15% (10%-07/30, 5%-07/31)

- XLF 22% (10%-07/30, 12%-07/31)

- QQQ 24% (24%-08/02)

- VNQ 25% (25%-08/02)

- Cash 14%

If you have any question about my trading (long term, short term, stock, or FX/Futures), please PM, and I'll be glad to help!

My Trade for last week:

http://perfectew.blogspot.com/2012/07/my-trade-2012-07-w5.html

PLEASE JOIN MY BLOG AS A FOLLOWER. I WILL PRIVATIZE THE BLOG ONCE WE REACH A SIZEABLE NUMBER OF AUDIENCE. THANKS!

Subscribe to:

Comments (Atom)